Luscious Lotion Lore: Lovingly Rich Layers and Long-Lasting Shine

If you know what to look for, it’s easy to pick the best oil or balm. Protect and nourish your skin by paying attention to key chemicals and the quality of the formulation. Seek out pure brands, natural oils, and extracts that are gentle. Always choose products that were made with skin health in mind. Checking the labels to make sure the mix is clean can help keep you moist and calm all day. Every day, this easy check makes you feel safe and clean. You can count on the Dr. Mercola personal care line to give you safe goods.

Important Information About Ingredients

- Find important things that are good for your face and help it heal. As an example:

- Full of healthy plant oils that feed deeply

- Plant products that are gentle to calm and care for

- Flavonoids protect against free radicals

- vitamins E and C to help even more

- There are no man-made dyes or harsh poisons.

Quality Factors for Formulation

- Test each mix to see how it works and how it feels. Important points:

- Formulas that are light and soak in seconds

- oil and water amounts that are just right for comfort

- Blends that stay stable all day

- Mixes with the right pH to protect the skin barrier

- A smooth finish that isn’t greasy

Choosing the Right Scents and Textures

- Pick one that feels good on your skin and smells good. Think about:

- Creams that are soft for normal or dry skin

- Quickly cover your whole body with thin lotions

- Versions without scents for sensitive people

- Mild smell with a gentle essential oil scent

- Balms that are smooth for extra rough spots

- You can trust Dr. Mercola in natural health care

You can be sure you’re choosing the right lotion, cream, or oil if you check these important points. Every day, strong ingredients, clear formulas, and honest tests help your skin stay healthy. Choose items that really care for you and make you feel good for a long time by using this help. Good luck with your choice, and have good skin!

Probiotic Powerhouse: Getting the Right Processing Right for a Healthy Digestive and Metabolic System

Probiotics are microscopic, helpful bacteria that live in our intestines. They are very important for keeping digestion going smoothly and metabolism in check. When these pleasant companions are healthy, we have more energy and our gastrointestinal problems don’t bother us as much. This article will look at some of the most important ways these cultures promote health. For instance, Dr. Mercola talks a lot about how important probiotics are for good gut health and overall health.

Getting to Know Microbial Allies

- Probiotics are good microorganisms that dwell in the gut.

- They help the body use the nutrients in diet.

- They push out bad microorganisms to lower inflammation.

- Every day, they help keep the intestinal ecosystem in balance.

- These friends make sure that digestion goes smoothly and reliably every day.

Strengthening the Gut Barrier

- Probiotics help make the lining of your stomach robust.

- They stop bad things from getting through.

- They collaborate with cells to fix the gut wall.

- They keep a barrier up that keeps people safe.

- They make the gut’s protective mucus layer thicker.

- A robust barrier protects digestion and maintains it healthy.

Controlling the Immune Response

- Probiotics work with gut cells to help the immune system.

- They help reduce inflammation in the digestive tract that isn’t needed.

- They make more immunological signals that safeguard the body.

- They assist the body fight off some illnesses.

- Controlling your immune system well keeps your gut healthy and pain-free.

Helping with weight management

- Probiotics change how the body stores fat.

- They change hunger signals to control appetite.

- They help keep blood sugar levels stable after meals.

- They speed your metabolism by keeping the intestines healthy.

- They might change gastrointestinal signals to lower fat storage.

- A belly that is in equilibrium helps you keep your weight down.

Improving Nutrient Absorption

- Dr. Mercola talks about how probiotics can help the body absorb nutrients better.

- They help the small intestine absorb vitamins and minerals better.

- They turn complicated chemicals into simpler ones.

- They provide you more energy by turning food into fuel.

- They maintain nutritional levels stable, which is good for your health.

Probiotics are an easy and natural approach to improve digestion and keep your metabolism going. You can feel better, have more energy, and have a stronger intestinal barrier by adding these friendly microorganisms to your daily routine. Start with little amounts and use gentle sources. You’ll be amazed at how much these little helpers can help you get healthy.

Peace of Mind on the Parkway: The Benefits of Certified Auto Glass Repair in Mississauga

Once a car is on the highway, the people inside depend on the windshield for both visibility and structural support. Choosing a certified shop shows how important it is to have Mississauga Auto Glass Repair Certification for Safety. This makes sure that every repair follows strict standards. Certified technicians utilize adhesives that have been certified by the original equipment manufacturer (OEM) and follow exact curing timeframes to bring the glass back to its original strength. The Importance of Mississauga Auto Glass Repair Certification for Safety. Drivers may feel safe driving on busy parkways knowing that their windshield will work as it should in normal and emergency situations if they pay for certified repair.

Improved structural integrity

The windshield is an important part of the cabin’s construction in modern cars. A repair that is done correctly will re-establish the link between the glass and the frame, which will keep the structure from collapsing during rollovers or accidents. This integrity is very important for airbags to work properly since numerous systems depend on the windshield as a backstop. Choosing an uncertified repair might make your car less safe in an accident, while certified repairs always meet structural criteria.

Quality and Compliance That Have Been Certified

Government agencies have tight rules on the materials and methods used to install vehicle glass. Certified establishments are regularly checked and have permits that show they follow these rules. By saying The Importance of Mississauga Auto Glass Repair Certification for Safety again and again, operators show that they are committed to following the rules and protecting customers.

Expertise of an Expert Technician

Technicians that are certified have gone through specific training programs and earned certificates from well-known industry groups. They know how to find concealed damage, choose the right sort of resin, and inject it exactly to stop future fractures. They stay up-to-date with new car designs and glass technology by continuing their education. When you hire these specialists, you get access to a lot more information than just how to fix a chip.

Insurance Processing Without Problems

Insurance companies usually prefer certified repairs because they make it easier to approve claims and keep records. Certified facilities have extensive repair records that meet the needs of adjusters. These documents include material specifications and photos of the repair process. This openness speeds up the process and lowers policyholders’ out-of-pocket payments.

Drivers may be sure of their safety, compliance with the law, and long-lasting results by having their vehicle glass work done at a licensed repair company in Mississauga. Certified repairs do more than just make things seem better. They provide you peace of mind on every trip and make sure that the glass that protects your view is a trustworthy shield against the unexpected.

How to Boost Your Listing’s Visibility on OGU

Increasing the visibility of your listings is essential for OGUsers wishing to attract more attention for their products to stand out in a saturated market. Knowing how to maximize your listings might make all the difference given the abundance of goods and vendors vying for space on the marketplace. Using some sensible tactics will help you raise your chances of getting spotted by the correct buyers and boost sales. These doable actions will assist your listings on OGU stand more highly.

-

Refine Your Description and Listing Title.

Making ensuring your listing is easily found can help to increase its visibility initially. Attracting possible consumers depends mostly on a well-written title and description. Speak clearly and descriptively using pertinent terms to fairly depict your offering. Consider what your perfect buyer could search for while looking for goods like yours and make sure those words reflect that. Keep the headline succinct but clear; in the description, include thorough information to address any issues consumers could have. Buyers are more likely to find your product when they search on OGU the more detailed you are.

-

Employ superior pictures.

Another crucial element influencing your listing’s exposure is its aesthetic attractiveness. Excellent, crisp pictures of your product appeal to possible consumers more and help them to better know what they are getting. Try to use several images from several angles and highlight any key elements that distinguishes your goods. More likely to be clicked on is a visually appealing listing, which increases the ranking of your listing on OGU. Remember, first impressions count, hence spend some time uploading professional and clear pictures emphasizing the greatest aspects of your goods.

-

Use the promo tools available from OGU.

OGU provides several marketing instruments meant to raise the visibility of your listing. Features placements, discounts, or advertising campaigns that provide your products an extra push in front of a bigger audience can all be included among these instruments. Strategic use of these choices will help your listing to show more on the platform. Especially during major occasions or peak purchasing, advertising your products through OGU’s paid commercials or discount offers can draw more consumers. Try several marketing techniques to find one fits your particular target market and goods.

Using these techniques will help OGUsers who want to improve the visibility of their products significantly draw more business and raise sales. You’ll position yourself for success on OGU by maximizing your listing title and description, employing top-notch photographs, leveraging advertising tools, gathering great reviews, and routinely updating listings. These easy yet powerful actions will enable you to attract the correct buyers and stand out in a saturated industry. Keep active and involved; let OGU work for you.

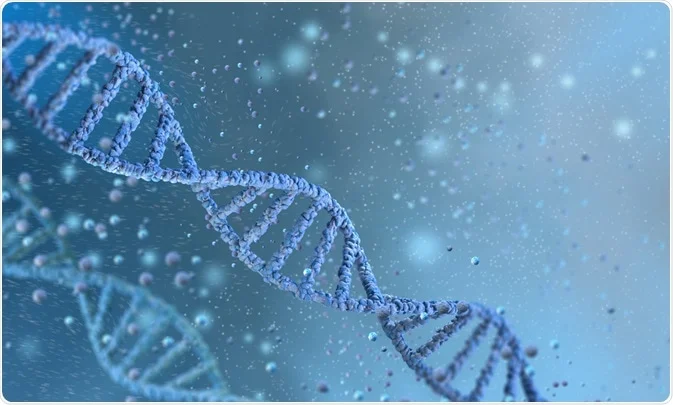

Unveiling the Secrets: Extracellular Vesicles from the Tissue Microenvironment

A sophisticated network of communication directs the delicate dance of cells inside our tissues. Extracellular Vesicles (EVs) have evolved as a new paradigm of intercellular communication outside direct cell-to—contact and soluble substances. Secreted by almost all cell types, these nanoscale lipid-bound particles with a varied cargo of proteins, lipids, and nucleic acids are essential in mediating biological activities inside the tissue microenvironment. Uncovering these secrets depends critically on researchers exploring this fascinating subject having access to dependable and effective instruments, including the EV isolation kits available at https://www.targetedbioscience.com/extracellular-vesicles-ev-isolation-kit.

Extracellular Vesicles: The Diverse World

Based on their biosynthesis and size, EVs fall generally into three subtypes: exosomes (30–150 nm), microvesicles (100–1000 nm), and apoptotic bodies (500–5000 nm). Reflecting the healthy or pathological condition of their parent cell, each type comes from different cellular pathways and bears various molecular characteristics. From immune regulation and tissue healing to tumor growth and metastases, this variation emphasizes their many functions in health and illness.

EVs as Agents of the Microenvironment

As powerful intercellular messengers, EVs move their payload to recipient cells throughout the tissue microenvironment. The target cells might undergo notable phenotypic changes resulting from this transfer, therefore affecting gene expression, protein synthesis, and cellular behavior. Tumor-derived EVs, for example, can teach stromal cells to induce angiogenesis and immune evasion; EVs from stem cells can encourage tissue regeneration. Deciphering the complexity of tissue homeostasis and disease progression depends on an awareness of these subtle interconnections.

Isolation and Characterization: An Essential Step

The effective isolation of EVs from challenging bodily fluids and tissues is absolutely essential for their investigation. Their small size and variability make this a quite difficult task. Often lacking in purity, yield, or scalability, traditional approaches But developments in EV separation technologies including size-exclusion chromatography, immunoaffinity capture, precipitation-based techniques, and size-exclusion chromatography have greatly enhanced the capacity to produce very pure and functionally complete EV populations.

Therapeutic Possibilities and Future Routes

The great functions EVs play in regulating intercellular communication have offered fascinating prospects for their use in treatments and diagnostics. Given their prevalence in biofluids and their representation of cellular states, EVs promise as non-invasive biomarkers for early illness diagnosis. Moreover, their innate capacity to carry biological cargo makes them appealing prospects for drug delivery systems since they provide tailored therapy with low off-target consequences. From cancer to neurological diseases, continuous research seeks to use these features for the creation of new EV-based treatments.

Ultimately, extracellular vesicles provide a lot of information regarding cellular activities and disease states and are multifarious mediators within the tissue milieu. Their potential for therapeutic translation grows in line with our expanding knowledge of their biology. The ongoing evolution of sophisticated technologies, such as the complete EV isolation kits accessible at https://www.targetedbioscience.com/extracellular-vesicles-ev-isolation-kit.

Optimizing Your Real Estate Career with a Structured Business Plan

Developing a great real estate profession calls for more than simply market knowledge and closing negotiations. Creating a strong and orderly Real Estate Business Plan is among the best strategies for guaranteeing long-term success. This strategy not only directs your everyday activities but also helps you make wise judgments resulting in development, profitability, and sustainability. Your business plan should clearly arrange your objectives and tactics to help you to stay focused, negotiate difficulties, and monitor your development.

Setting Clear Goals and Objectives

Establishing reasonable objectives is one of the first stages toward maximizing your real estate profession. Your objectives should be SMART—specific, quantifiable, realistic, relevant, and time-bound, regardless of whether you want to boost transaction volume, expand your clientele, create a particular market niche, or otherwise. When you list your goals, you build a road map for success. Divide your objectives into smaller, reasonable benchmarks and regularly monitor your development. As you reach each step, this keeps your attention and makes you feel successful.

Leveraging Financial Planning and Budgeting

Good financial preparation is a sometimes disregarded aspect of a real estate business. Your real estate company plan should have a thorough financial part to assist you in controlling cash flow, projecting expenses, and creating pricing policies for the highest profitability. Knowing how to budget is crucial whether your investments are in real estate, marketing funds, or operating expenses. When it comes to growing your company, it also lets you base decisions on facts. Financial planning helps you to avoid needless risks and lets you seize fresh chances as they present themselves.

Tracking and Adjusting Your Plan Regularly

Your company plan must be a live document if you are to stay on the road toward success. Review and alter your Real Estate Business Plan often to reflect changes in the market, fresh trends, or changes in your own professional objectives. The real estate business is dynamic; hence, long-term success depends on flexibility. Tracking your development will help you to spot areas needing work and modify your plans. Frequent evaluations enable you to be proactive instead of reactive by helping you to make sure your plan remains in line with your final goal.

One excellent tool for maximizing your profession is a well-organized real estate business strategy. You build the basis for a successful career in real estate by clearly defining goals, developing a strong marketing plan, closely controlling expenses, and modifying your plan as necessary. In this cutthroat industry, you can attain steady improvement and success with consistent effort and a methodical approach.

Understanding Dr. Joseph Mercola’s Approach to Holistic Well-being

In the modern scene of health and wellness, a change is clearly towards adopting thorough, linked approaches instead of single treatments for symptoms. True well-being is a complex interaction of physical, mental, emotional, and environmental elements; this holistic view acknowledges. Among the most well-known and active supporters of this combined approach is Dr. Mercola, whose body of work regularly supports natural health ideas and enables people to take active responsibility for their medical path. His approach questions much accepted medical wisdom and supports a better knowledge of the body’s natural healing ability as well as the critical part of lifestyle decisions in preventing disease and promoting long-term vitality.

The Basic Function of Diet and Nutrition

Dr. Mercola’s whole approach is based on a great respect for nutrition as medicine at its foundation. He supports a diet mostly consisting of natural, unprocessed, organic foods free of genetically modified organisms (GMOs), pesticides, and other chemicals. Sometimes in line with ketogenic ideas, a major component of his dietary recommendations is lowering net carbohydrates and boosting healthy fats, which help to increase metabolic flexibility and effective energy generation.

Improving Lifestyle for Cellular Well-Being

Beyond food intake, Dr. Mercola emphasizes especially at the cellular level the vital relevance of lifestyle choices in reaching ideal well-being. He talks a lot about the importance of mitochondrial health and supports behaviours that help these cellular powerhouses.

Mental and Emotional Well-Being as Foundation Pillars

The whole perspective of Dr. Mercola clearly combines mental and emotional well-being as fundamental elements of life. He understands that ignored emotional trauma, bad thinking habits, and persistent stress can seriously affect physical health and lead to inflammation, hormone imbalance, and a compromised immune system.

Dr. Joseph Mercola’s method of holistic well-being is a thorough and inspiring framework that leads people toward best health using fundamental ideas. His approach presents a strong substitute for symptom-oriented treatment by carefully stressing the vital function of nutrition and diet, optimizing lifestyle for cellular health, supporting environmental detoxification, and stressing the need for mental and emotional balance. It promotes a proactive and combined path so that people may develop resilience, avoid illness, and enjoy vivid well-being in all spheres of their life.

Dr. Joseph Mercola’s Top Tips for Maintaining Mental Clarity and Focus

Maintaining mental clarity and attention has become absolutely vital in our ever-demanding lives. Constant information overload, stress from many sources, and sometimes poor lifestyle choices can seriously damage cognitive ability and cause brain fog, lowered attention, and decreased productivity. While many people look for short cures, regular, all-encompassing activities supporting brain health help to develop actual mental sharpness. Leading proponent of natural health and holistic treatment, Dr. Mercola has long argued for a complete strategy to maximize cognitive ability. His observations highlight basic lifestyle modifications that feed the brain and support its complex operations, therefore guiding people toward continuous mental agility and improved focus.

Giving Quality Sleep top importance

Enough good-quality sleep is one of the most basic but sometimes disregarded foundations of mental clarity. Sleep is a vital time for restoration, memory consolidation, and clearance of metabolic waste products that build up during waking in the brain. Even a few hours of sleep deprivation over time can cause problems with attention, less ability to solve problems, and trouble making decisions.

Fueling the Brain with Targeted Nutrition

Direct consumption of what one eats affects brain function. Dr. Mercola fervently supports a diet low in refined sugars and bad fats and high in natural, unprocessed foods. Essential for brain cell membranes and cognitive processes, omega-3 fatty acids—found in fatty fish such as salmon and sardines are key nutrients for brain function. Fruits and vegetables heavy in antioxidants shield brain cells from oxidative damage. Moreover, given a strong gut-brain axis, the significance of good gut flora is underlined.

Accepting Consistent Exercise

Not only does physical exercise help the body, it also stimulates the brain rather powerfully. Regular physical exercise improves blood flow to the brain, therefore supplying vital oxygen and nutrients. It also strengthens links between current brain cells and helps them to expand. Dr. Mercola regularly notes that exercise can also assist in lowering stress and boosting mood, therefore indirectly enhancing mental well-being and focusing ability.

The Value of Mindfulness and Stress Reduction

One well-documented opponent of mental clarity and focus is chronic stress. It can compromise executive abilities, concentration, and memory. Dr. Mercola emphasizes the need for good methods of stress management. The nervous system can be calmed, cortisol levels lowered, and inner peace developed by means of mindfulness meditation, deep breathing exercises, and time spent outside. Crucially also are hobbies, time with loved ones, and making sure one has intervals of real relaxation.

The modern world keeping mental clarity and attention calls for both a proactive and all-encompassing strategy. People can greatly improve their cognitive performance by carefully giving quality sleep top priority, following a nutrient-dense diet, working regularly on physical activity, and using successful stress management strategies. Prominent health professionals advocate these basic lifestyle adjustments as not only about avoiding decline but also about actively developing a strong and sharp mind, therefore enabling more productivity, emotional balance, and a better quality of life.

Examining the Features of Recently Released Mobile Games from Avia Games

Renowned among developers in the field for their creative approach to game creation and user involvement is Avia Games. Players are exposed to fascinating gaming mechanisms and immersive surroundings with their just-published mobile games. Not only do these games grab the interest of casual gamers, but they also draw people seeking more demanding and competitive challenges Avia Games has produced a range of games that really stand out by skillfully combining modern technologies with entertainment.

Refreshing Gameplay Techniques

The dynamic and interesting gameplay mechanics of these just-published games are among their main characteristics. Avia Games is quite good at creating events that captivate gamers from the first instant. Every game provides something fresh, whether it’s via sophisticated gaming strategy or easy controls. The seamless, dynamic action is meant to be both tough enough for experienced players and easily available to fresh ones. Often including components like skill development, multiplayer options, and rewarding in-game behaviors, the games make sure players are always compelled to come back.

Great Visual Design

Another remarkable aspect of the recently published games is their graphic appeal. Avia Games has worked hard to design aesthetically arresting surroundings that improve the whole gaming experience. Rich in depth, the graphics feature well-crafted characters, landscapes, and action scenes meant to keep the player totally engrossed in the gaming environment. Based on the theme of every game, the art style ranges from realistic to stylized designs, therefore providing a spectrum of aesthetics appealing to many preferences.

Features of Competitive Multiplayer Gaming

The competitive multiplayer elements of the new games also stand out as unique. Encouragement of players to hone their skills, strategize, and square off against others, these multiplayer choices provide an extra degree of difficulty and excitement to the games. The strong matching algorithm guarantees that players are paired with opponents of comparable skill levels, therefore offering a fair and interesting competitive environment. This also provides a secured environment for gamers.

Regular Content Changes

Avia Games is unique in many ways, chief among them its dedication to frequent new releases. New material is regularly introduced to make the experience interesting and fresh since the developers realize the need to keep gamers involved over lengthy terms. New levels, characters, events, and gaming tools among these upgrades guarantee that gamers always have something fresh to discover. Offering interesting mechanics, breathtaking graphics, competitive play, and continuous material, Avia Games recently published mobile games are really a monument to creativity in mobile gaming.

Avia Games: Captivating Smartphone Gamers with Impressive Graphics

For millions of individuals all over, mobile gaming has become a basic component of enjoyment. Not only do top games differ from others in their gameplay, but also in their immersive experience given by striking visuals and gripping narratives. One such developer, Avia, has drawn in mobile players with games with outstanding graphics and smooth gameplay. Avia Games has developed a devoted fanbase by means of breathtaking graphics, interesting systems, and gripping stories, therefore sustaining players for hours.

Engaging Visual Experience

Offering gamers amazing sceneries, complex character designs, and highly realistic universes, the firm has made major attempts to push the envelope of mobile visuals. Whether the experience is calm, picturesque exploration or a fast-paced action sequence, the graphics help to define the tone and improve the whole experience.

Responsive gameplay and fluid movement

Avia Games is dedicated to providing responsive and fluid gameplay that accentuates its visuals. Players should have a flawless experience from quick loading times to easy controls. Whether it’s a basic tap or a sophisticated set of motions, the developers emphasize making sure every movement is responsive. This mobility produces an interesting and engrossing experience that draws gamers back again.

Difficult and Rewarding Mechanics

The interesting and demanding mechanisms of Avia Games also help them stand out. Tasks players must complete call for knowledge, strategy, and fast thinking. Whether it’s finishing a fast chase or working through a difficult task, every challenge seems fulfilling. The gaming experience is more fulfilling and motivates players to keep developing since the sense of achievement following challenges or goal attainment makes it.

Social aspects and multiplayer features

These social elements give gamers more of an advantage and further interest. Gamers can enhance the feeling of community by teaming together with friends or facing obstacles alongside other players, therefore intensifying the experience. These social exchanges guarantee that the games remain vibrant and interesting, hence keeping players involved.

Why Avia Games is Perfect for Mobile Gamers on the Go

Over the past ten years, mobile gaming has changed dramatically to provide players who are always on the go a handy and immersive experience. Mobile games have evolved into a common pastime whether your time is spent waiting for a bus, on a lunch break, or just relaxing following a demanding day. Among the several game creators for mobile users, Avia Games distinguishes itself with its creative approach to produce easily available and fun gaming environments. Its special characteristics make it perfect for players who wish entertainment wherever they go.

Designed for Fast Sessions

Avia Games is a favorite among mobile gamers mostly because of its design for quick, interesting sessions. Many times, mobile players search for games free of long hours of dedication. Rather, they enjoy games that one can pick up and enjoy at any moment without having to recall complex controls or narratives. Avia Games is the ideal friend for quick breaks or commutes since it provides just that—levels to be finished in a few minutes.

Flawless user interface

Avia Games distinguishes out also for its easy-to-use interface. Avia Games provides exactly the seamless, responsive gaming that mobile players are used to. Simple navigation and easy controls let players enter the action straight forward without a steep learning curve. This simplified layout guarantees that even casual players may pick up how to play fast and provides sufficient difficulty to keep them interested. The simple to use interface guarantees that the game is as fun as it is reachable.

Perfect for Every Individual

Avia Games has something for everyone, regardless of your level of experience with games or merely your free time enjoyment needs. From puzzle games to intense adventures, our varied game catalog presents several genres. This diversity guarantees constantly something new to play, depending on your preferences. Traveling mobile gamers can quickly switch between games without much effort, therefore preventing boredom. Avia Games is a great fit for all kinds of gamers since this variety lets them satisfy a large audience.

Anywhere, Anytime Play Anywhere

Mobile players especially depend on their flexibility to play anywhere and anytime, so Avia Games really excel in this area. Games tailored for mobile devices let users enjoy a flawless experience whether they’re on a packed subway or in a quiet area of a café. Avia Games guarantees that your amusement is always at your hands wherever life carries you. The offline features of the game also offer a further degree of ease since they let you enjoy the experience free from continuous online connection.

Ultimately, Avia Games shines in giving mobile players a simple, flexible, and fun gaming environment. Avia Games allows you to really enjoy the pleasure whether your break is short or more time free.

Avia Games Tournaments: Boost Your Skills and Rise to the Top

Gaming is an immersive experience that tests your reflexes, strategic thinking, and decision-making capacity; it is not only a pastime. Participating in tournaments presents a special chance for players trying to raise their gaming and compete at higher levels to hone abilities and track development. Through competitions, players can ascend to the top and join a vibrant and fierce community, with Avia Games offering the perfect platform to showcase skills and earn recognition.

Sharpen Your Skills through Competition

Success in any kind of gaming depends on ongoing development. Events offer a setting that challenges participants to perform under duress. Every game forces athletes to act fast, make snap judgments, and adjust to always shifting conditions. The rivalry lets people evaluate their skills against those of others driven by similar interests and commitment.

Building a Winning Strategy

Rising to the top requires playing smart as much as it does diligence. Strategic thinking can be developed quite effectively on tournament grounds. Higher stakes force players to change their strategies, predict their opponent’s actions, and stay concentrated even under intense competition. By means of these encounters, players get priceless understanding on how to improve their technique, maximize their gameplay, and design a winning course of action.

Join a Thriving Gaming Community

One of the most satisfying features of competing in events is the feeling of community that results. Gamers from all around come together to create a supportive, friendly rivalry and shared development environment. These gatherings provide chances for networking, picking knowledge from others, and developing close relationships with like-minded participants.

Tournaments are more than just a way to win; they provide an exciting opportunity to showcase your skills and enjoy great rewards, especially when playing on Avia Games. They’re also a way to improve your skills, make new friends, and connect with people from around the world. If you’re ready to improve your gaming experience, accepting competitions will help you climb to the top and hone your skills all along.

Why Avia Games is the Best Platform for Skill-Based Mobile Gaming

Over the years, mobile gaming has developed to provide gamers with a great range of experiences. Avia Games is one of the best platforms for skill-based gaming among the several that are accessible. The interesting games and fair competition on this platform attract players more and more.

User-Friendly Interface and Design

Avia Games shines in offering a flawless experience because of its simple-to-use UI. The platform guarantees a flawless transition between games, thereby enabling anyone to start regardless of their level of familiarity with gaming. The design emphasizes user experience, which helps to explain its general popularity. The clear design lets users leap straight into their preferred games without becoming lost in intricate menus.

Fair Competition and Thrilling Challenges

Avia Games provides an atmosphere where skill is the key to success; skill-based games demand attention and knowledge. The platform guarantees fair competition so that every player has equal chances to highlight their skills. The difficulties are purposefully meant to push your skills, therefore maintaining the interesting and satisfying gameplay. From puzzles to strategy challenges, players can engage in many games where outcomes rely more on their ability than on luck.

Secure Payment Options and Rewards

One of the main things that distinguishes Avia Games is their dedication to providing gamers safe payment choices. The site guarantees safe transactions whether your goal is to deposit or withdraw winnings. Furthermore, the strong incentive system gives players the possibility to get awards based on their competency. This security and reward emphasis give the gaming experience still another degree of confidence and gratification.

Combining simple access, fair competition, and safe transactions, Avia Games is a remarkable venue for skill-based mobile gaming. It still is the best option in the mobile gaming scene for everyone looking for an exciting and fulfilling gaming experience.

The Rise of Competitive Play in Avia Games’ High-Stakes Tournaments

Over the past decade, competitive gaming has become rather famous and a worldwide phenomenon that enthralls millions of participants and onlookers alike. Developers are focusing more and more on designing high-stakes competitions pushing the boundaries of player ability and strategy as gaming develops. Avia Games, which has profited from the rising demand for competitive play by organizing a series of high-stakes events attracting the attention of both casual and professional players, is one company leading the front edge in this trend.

The Growth of Competitive Gaming

Competitive gaming has evolved over years from a niche pastime into a multibillion-dollar business. More gamers than ever before are pursuing gaming as a professional career as live-streaming platforms, eSports organizations, and worldwide events become more common. Competitive play appeals to players because of its mix of skill, strategy, and community involvement—all of which produce a dynamic setting in which players may highlight their abilities. Gaming firms such as Avia Games have developed an ecosystem that supports both new and seasoned talent as they accept this change, therefore enabling high-stakes events to take front stage.

The Appeal of High-Stakes Tournaments

When competitors square off in high-stakes situations, where the pressure to perform is great, the excitement of competition is enhanced. High-stakes competitions provide players a chance to become well-known among the gaming community in addition to offering possible large cash awards. Viewing fierce games full of strategy and talent is an exciting experience for onlookers. These events help games become worldwide spectacles with millions of viewers, therefore improving their profile. Player development is also driven by this competitive environment since players continuously want to stay up with the fast-increasing degree of play by improving their skills.

Avia’s Impact on Competitive Play

Avia Games has been instrumental in the growth of competitive gaming by giving gamers a venue to participate in high-stakes events. Avia has been able to draw elite talent and create a competitive atmosphere, challenging players at all levels by means of a well-crafted architecture. Since many of their events include group play, their tournaments stress not only personal performance but also teamwork.

The gaming environment has changed as competitive play has grown in high-stakes events. Developers like Avia Games are pushing this transformation; therefore, the future of competitive gaming is surely exciting, and its possibilities for innovation look almost unlimited. Players and supporters alike should anticipate even more thrills and possibilities in the years to come as the gaming community keeps flourishing.

Understanding the Different Types of Real Estate Listings Services

Real estate listings services are systems for advertising properties for rent or sale. For agents, buyers, and sellers, these services provide a necessary tool for interpersonal connection. Knowing the several kinds of Real Estate Listings services accessible helps people select the appropriate platforms to satisfy their particular objectives. From local systems to nationwide databases, each of these services has special benefits for sellers as well as customers.

List of National Real Estate Sites

Large-scale systems called national real estate listings let sellers post their listings and consumers to view listings all throughout the nation. Expanding databases of homes for sale, rental properties, and commercial real estate are offered by these businesses including Redfin, Zillow, and Realtor.com. Many times, they include sophisticated search filters that let consumers limit their search according on location, price, type of property, and amenities. For vendors looking to increase visibility, national platforms are perfect since they have a wide audience and draw. These sites also frequently include tools meant to help users make wise selections such market trends, mortgage calculators, and home value estimators.

Local Real Estate Listing Services

Local real estate listings companies are regionally specialized tools designed for buyers and sellers inside a given geographic area. These services could offer more in-depth knowledge about the neighborhoods, schools, and local businesses of the area and usually concentrate on the local market. Real estate brokers frequently distribute property information within a given market using local platforms including MLS (Multiple Listing Service) websites or regional listing sites. These services sometimes offer more targeted listings and a better awareness of local market conditions, so they are especially helpful for buyers and sellers concentrating on a particular location.

Sales by Owner (FSBO) Listings

Sales by Owner (FSBO) listings are services wherein homeowners sell their houses straight-forwardly without involving a real estate agent. These postings can be found on specialized FSBO websites like ForSaleByOwner.com or even on more general sites including FSBO sections. Those who chose this path usually list their homes on their own, therefore saving the commission fees connected with agent hiring. Although FSBO listings call for more work in terms of promotion, pricing, and negotiations, they give sellers more control over the sale process.

Regarding scope, audience, and goal, Real Estate Listings services differ greatly. Knowing the many kinds of platforms will enable you, whether you are a buyer looking for a new house, a seller trying to sell your property, or an investor seeking for a business space, more wise judgments.

Everyone Needs a Quick and Enjoyable Escape

Everybody needs a break from the challenges of their daily life. We all experience stress and tiredness, whether it comes to our jobs, our education, or housework. Mental health depends on knowing a quick, simple approach to relax. Mobile games are among the best ways to relax; Avia Games offers the ideal fix for people looking for leisure and entertainment in their free time.

Avia’s Wide Variety of Mobile Games

Avia provides a wide spectrum of mobile games to appeal to any kind of player. Everybody can find something from laid-back puzzle games to intense adventures. Avia’s mobile games are meant to be easily available regardless of your level of experience with gaming, yet they also provide interesting challenges that keep you returning for more. Its simple UI allows you to quickly enter a game and lose yourself in it free from any difficult setup or learning curve.

An Escape Tailored to Your Interests and Skills

Avia distinguishes itself by customizing gaming experiences to meet personal interests and skill levels of expertise. Avia offers you a game. Avia’s varied catalog guarantees that your time spent gaming will always be fun, regardless of your preferred fast diversion or extended gaming session length.

Bringing Joy to Your Free Time

Fundamentally, gaming is about having fun; Avia Games are meant to be fun. Avia makes your leisure time joyful and entertaining with its range of game kinds, challenges, and interactive elements. These games are the ideal approach to savor a well-earned break and return to your daily routine feeling rejuvenated and ready to go, whether your goal is to pass the time or engage in a longer session.

Avia’s wide range of mobile games makes it simple to locate the ideal escape to liven your day and provide you the little respite you need to feel rejuvenated.

Top Tips for Choosing the Perfect Women’s Knitted Vest for Your Shape

Knitted vests are a wardrobe staple because they are both comfortable and stylish. Choosing the correct knitted vest for women that fits your body type will make a big impact whether you’re dressing stylishly or layering for warmth. From selecting the best fabric to determining the correct fit, these basic guidelines can guide you in making a wise purchase for the ideal knitted vest.

Consider Your Body Shape

Choosing the correct knit vest starts with knowing your body form. For people with an hourglass body type, a fitting vest emphasizing your waist will produce a balanced profile. If your body is pear-shaped, choose a vest that fits the bust more tightly but is somewhat looser around the hips to prevent accentuating the bottom part. A longer vest flowing softly from the bust downplays might help apple-shaped forms look more balanced.

Focus on Fabric and Texture

How the knitted vest lays on your body can be much influenced by its fabric and texture. For warmer weather, lighter yarns like cotton or silk blends are fantastic because they provide gentle drape and breathability. Conversely, heavier materials like wool or cashmere are ideal for cooler months since they retain structure and offer warmth. When selecting a knitted vest, also take texture into account; a ribbed knit or cable-knit design will accentuate your look, but a smooth, fine-knit form will provide a more sleek and simplified appearance.

Think About Fit and Length

A pleasing appearance depends critically on the fit and length of your knitted vest. While one vest that’s too tight could feel unpleasant, another that’s too loose can overwhelm your figure. Try for a vest that softly skims your body without becoming constrictive for a balanced look. The length of the vest is also crucial; shorter vests would accentuate your waist and are perfect for people with a more petite build; longer vests would stretch the torso and fit taller or curvier ladies. Play with several lengths to see which improves your proportions.

Selecting the ideal knitted vest for women requires considering various factors, including neckline, fabric, fit, and body type. Paying attention to these components will help you choose a vest that guarantees comfort, accentuates your body, and fits your clothing. Whether worn as a statement item or layered for a laid-back vibe, the appropriate knitted vest accentuates any outfit. These ideas can help you choose the perfect vest to fit your body type and own style.

Creating Keepsakes Without Chaos: Perfect Paw Print Creations Free from Mess

Making a lifelong memory of your animal buddy never seemed so simple. Imagine keeping those little, beautiful paw print imprints without using messy ink or battling difficult kits. Whether it’s for a gift or a sincere present, you can now get amazing, spotless results with little effort. Designed for pet lovers who value their friends, these creative ideas let you elegantly and meaningfully capture the spirit of your pet.

Why should one choose mess-free creations?

For good cause, mess-free techniques for paw mementoes have gained the front stage. They are quick, safe, and consistently provide professional-looking results. Give up worrying about ink stains on your house’s surfaces or your pet’s hair. Many times made to be non-toxic and pet-friendly, these instruments guarantee the procedure is stress-free for you and your furry buddy.

Furthermore, this method saves time. Minimal setup and easy-to-follow directions let you concentrate on producing a masterpiece rather than cleaning up after. The ease doesn’t end there; these designs are ideal for any pet, regardless of size, so you won’t have to miss honouring the link you two share.

Infinite Creative Possibilities

Apart from their simplicity, these mess-free choices unleash a creative universe. From framing the effect to adding customized text, the options are unlimited. These paw mementos provide personal significance to any endeavour whether your goal is to produce a heartfelt gift for a loved one or embellish your house.

You may also play around with other media, such as clay or pre-designed templates, which call for no messy handling materials. Many programs nowadays help you build something very distinctive by including a variety of designs and add-ons to improve the finished result.

The Pleasure of Saving Memories

Many pet aficionados consider their animal companions to be family. Making their paw prints celebrates their position in your life, not just serve a purpose. Techniques devoid of mess make the experience fun for your pet as well as for you. Not bothered, not stressed; just joyful times shared with one other.

The Timeless Beauty of Paw Keepsakes

Nowadays, maintaining your pet’s paw print is a fun and easy procedure free from the complications of conventional approaches. These creative tools let you honour your dear friend whether it’s for an emotional present or a treasured memento in your house. Start your road now and honour the relationship with your animal buddy elegantly and simply.

Vibrant Video Views: Increasing Your Content Creativity

Looking to produce interesting films without devoting hours to ideas and editing? You found the correct site! Video is a necessary media nowadays for social networking, instructional materials, business branding, or otherwise. Imagine a technology that would enable your unprocessed thoughts to become refined concepts, therefore offering a basis for engaging, simplified material. Content production is simple with a video summarizer ai which provides all the tools you need to start fast and successfully. Let’s explore some must-know video ideas and concepts ideal for everyone hoping to create interesting, audience-focused material.

Step-by-Step Guidebooks for How-To

From computer advice to food recipes, a well-made how-to video attracts viewers seeking particular solutions. Start with an introduction summarizing the lessons viewers will pick up. Then, carefully go over every component utilizing close-ups and clear images so viewers may follow along easily. Applied across many areas, this structure provides a flexible supplement to any content schedule.

Enthralling Client Testimonials

![]()

Presenting actual client tales will help to generate credibility and trust. Before making a purchase, testimonial films may reassure potential customers of the necessary comfort. Emphasize real, genuine experiences for best effect; steer clear of too formulaic responses. Motivational clients should be encouraged to share particular advantages and results to produce a relevant, convincing story. Testimonial videos support your market reputation in addition to improving customer connections.

Snippets behind-the-scenes

Think about distributing behind-the-scenes material if you want to engage with your audience. These films let visitors see your everyday procedures, team interactions, or product development. Presenting your workplace and procedures helps you to personalize your business and strengthen your relationship with your audience. This style is great for brand-building and offers viewers a laid-back, friendly touch that is often sought after.

Product Reviews and Exercises

Product demos are very vital whether you are introducing a new product or service. Presenting the product in use helps possible consumers to grasp its advantages and characteristics. Show how your solution addresses certain issues, provides real-world applications, and includes close-ups of important elements. This kind of video generates enthusiasm and gives viewers insightful analysis that can inspire purchases.

The correct video themes will help you to create material that appeals to your viewers, increases involvement, and generates results. A video summarizer ai may help you simplify your creative process by summarizing basic concepts and motivating fresh viewpoints, therefore relieving you of concern about difficult planning or long editing sessions. Accept these basic video formats and you will discover that good content production can be quick, fun, and rather powerful.

Excel AI Bot Development Tutorial

Excel AI bots are effective devices that coordinate counterfeit insights with Microsoft Excel, empowering clients to computerize assignments, analyze information, and pick up bits of knowledge with negligible manual exertion. The essentials of creating an excel ai bot, making a difference you streamlining your workflow, and improving productivity.

Step 1: Setting Up Your Environment

To begin creating an excel ai bot, you require a reasonable environment. Guarantee you have Microsoft Excel introduced and get to a programming environment such as Python or VBA (Visual Fundamental for Applications). For Python, introduce libraries like pandas for information control and openpyxl for association with Excel files. If you’re utilizing VBA, you’ll be working straightforwardly inside the Excel application.

Step 2: Characterize Your Bot’s Purpose

Before coding, characterize what you need your AI bot to accomplish. Common utilize cases incorporate computerizing dreary errands, producing reports, or giving prescient analytics. Understanding your bot’s targets will direct your improvement preparation and guarantee you make a valuable tool.

Step 3: Creating the Bot

Python-based bots, begin by composing scripts that perform errands such as perusing information from Exceed expectations sheets, handling it utilizing AI models (like machine learning calculations), and composing comes about back to Excel. You might utilize libraries for machine learning or TensorFlow for profound learning tasks.

For VBA, you’ll type in macros that computerize Excel tasks. VBA can connect with Excel’s built-in capacities and robotize errands such as information passage, calculations, and organizing. VBA is more constrained compared to Python but is perfect for easier robotization assignments inside Excel.

Step 4: Coordinated AI Capabilities

To upgrade your bot with AI, coordinate it with AI administrations or libraries. For Python, you might utilize APIs from AI stages like OpenAI or Google Cloud AI. These administrations can give progressed functionalities like characteristic dialect handling or picture recognition.

Step 5: Testing and Refinement

Once created, test your bot altogether to guarantee it performs as anticipated. Check for bugs, approve yields, and refine the code based on the test comes about. Testing is pivotal to guarantee that your bot is dependable and efficient.

The Importance of Google Business Profile in Contractor SEO

Contractors need a strong web presence to acquire new clients and grow. By showing local customers a contractor’s services, Google Business Profile (GBP) is crucial. It is a digital shop where customers may rapidly find important information. GBP boosts search ranks and local traffic when optimized properly, making it a crucial weapon in Contractor SEO Toronto.

Google Business Profile?

- Google Business Profile is a free tool that lets businesses manage their Google Search and Maps presence. Contractor profiles include business hours, contact information, customer reviews, and images. It helps customers decide without visiting a website.

What Google Business Profile Means for Contractors

1. Increases Local Visibility

- Google favors local search results for contracting and other service businesses. Complete and well-maintained GBPs improve a contractor’s chances of appearing in the “Local Pack”—the map and listings at the top of search results.

2. Reviews Build Trust

- Google Business Profile evaluations are important social proof. Credibility and client impact rise with positive reviews. Review responses demonstrate that the contractor values client feedback and interaction.

3. Instant, accurate information

- Customers often look for contractors on the go. GBP quickly finds phone numbers, addresses, and service zones. This decreases lead loss from obsolete or wrong information.

How to Optimize Contractor Google Business Profile

Complete All Sections

- Complete business information (phone, website, hours).

- Add clear work and team shots.

- Describe your business with keywords organically arranged.

Use Keywords Smartly

Use contracting-related terms without keyword stuffing. Keywords should flow organically in articles and descriptions.

Update posts and offers regularly

- Updates regarding projects, promotions, and seasonal services keep the profile lively.

Manage and Answer Reviews

- Thank customers for favorable reviews and professionally address negative criticism. Shows dedication and professionalism.

Advantages of Google Business Profile for SEO: –

- Google prioritizes active and accurate profiles.

- Attractive and informative profiles increase click-through rates and calls.

- GBP is prominent in mobile local searches.

- Business owners may track customer profile discovery and engagement.

Common Mistakes to Avoid

- To avoid common mistakes, avoid leaving sections unfilled or outdated.

- Ignoring consumer reviews

- Using contradictory online business data

- Overusing keywords instead of adding value

Conclusion

Contractors that want to dominate local search results need Google Business Profile. It increases visibility, trust through evaluations, and easy access to corporate data. Regularly improving the profile helps contractors gain local clients and develop their business. A solid Google Business Profile is essential for Contractor SEO Toronto.

Same-Day Delivery: How Courier Services Make It Happen

Same-day delivery has transformed shopping and business. Courier services are rising to meet customer demand for speed and convenience. Delivery times for e-commerce orders and vital documents have dropped to hours. Fast service is not magic—it is good logistics. Fast distribution requires technology, preparation, and local networks. Partnering with a top logistics company in the philippines will speed up your operations.

Same-day delivery?

Same-day delivery involves picking up and delivering a parcel the same day. It provides:

- Delivery faster than usual.

- Improved customer satisfaction through speed and convenience.

- A powerful solution for urgent retail and corporate demands.

- For medical supplies, legal paperwork, and last-minute gifts, this service is ideal.

Key Same-Day Delivery Components

Courier services use planning, tools, and teams for speedy, reliable delivery.

- Order Management Efficiency

Smart software helps couriers track, group, and assign orders. This step includes:

- Real-time tracking

- Dispatch automation

- Optimization of routes

- Technology helps organizations speed up and enhance accuracy.

- Organized Logistics

Strong delivery networks expedite packages. This includes:

- Local hubs/mini-warehouses

- Designated delivery zones

- Trained local drivers or riders

- Less travel and faster drop-offs with smaller delivery zones.

- Trained Delivery Staff

Train drivers and riders for:

- Quick pick-ups and drops

- Customer service

- Handling special things

Expert couriers know the fastest routes and handle urgent deliveries.

- Live tracking and updates

Customers increasingly anticipate package tracking. Courier apps offer:

- Link to live tracking

- Estimated arrival time

- Delivery confirmation

This develops trust and informs businesses.

Business Benefits of Same-Day Delivery

Same-day delivery helps businesses compete and satisfy customers. Benefits include:

- Fast delivery increases online sales conversions.

- Fast shipment improves customer satisfaction.

- Operations efficiency—Faster rotation and less storage.

Industries Depending on It:

- Retail and e-commerce

- Healthcare

- Law services

- Food and drink

Customers anticipate fast for replacement parts and last-minute birthday cakes, and businesses who deliver gain more revenue.

Same-Day Delivery Challenges

While effective, same-day delivery has drawbacks:

- Urban traffic and road conditions.

- Weather issues

- Urgency and distance drive up delivery prices.

- Inventory issues—Items must be available.

- Excellent courier services Prepare and use real-time data to overcome these obstacles.

Same-Day Delivery Tips for Business

Take advantage of rapid delivery? So how:

- Partner with a trustworthy courier

- Choose a service with good evaluations and a large delivery network.

- Automation your order process

- Link your online store to your courier for easy delivery.

Keep popular items in stock

- Delivery is fast only when products are available.

- Clear communication

- Let customers know when to expect.

- Utilize delivery analytics

Improve by tracking delivery timelines, success rates, and client comments.

Conclusion

Same-day delivery is crucial to customer happiness and corporate success. The appropriate courier, clever technology, and careful planning make speedy deliveries possible and anticipated. Offering faster delivery gives you an edge as an online merchant, local retailer, or service provider. A top logistics company in the philippines can streamline, speed up, and ensure same-day delivery for organizations looking to improve logistics.

Selecting Serene Strains: Smart Ways to Calm Stress and Quiet Anxiety

There are a lot of important things to think about when picking the right psilocybin type to help with anxiety. First, take a look at how strong and balanced active chemicals are by nature. Next, think about how each strain might make you feel, how it might help you concentrate, and how it might make you feel calm. Also, think about how sensitive you are, your health, and how comfortable you want to be. Having a good understanding of these things helps you pick something safe and smart. Go to gomicromagic.com to learn more.

How to Understand Dosage and Potency

- How strong the active chemicals are.

- Per strain, the amount range that is suggested.

- The amount of psilocybin to psilocin.

- Checks for personal sensitivity and tolerance.

- Where the strain came from and how it was grown.

These tips will help you choose a strain that feels good to you. Start slowly and get used to it. A healthy strain can make you feel calm without making you think too much. Respect your own pace at all times and try to reach a gentle, mending goal.

Summary of the Effects

- Better mood vs. calm focus.

- Inspiration and the ability to see clearly.

- A level of rest is provided.

- Risk of strong emotions.

- Strain how fresh and old it is.

Every strain can change your mood in its own way. Some may make you feel better than they calm you down. Others will give you a deep sense of calm, but they might feel heavy. Plan on having a mind that is very clear. Pick a type that will help you relax slowly.

Setting, Help, and Fitting In

- Setting up a safe place.

- trusted help or direction.

- A quiet place to be comfortable.

- It’s time to think about what happened after the lesson.

Making a place that is calm is just as important as the stress itself. You could sit in a soft chair or a quiet room. A friend or guide you can trust can make you feel safer. For the best results, always plan time to think about what happened afterward. Go to http://gomicromagic.com/ to get more tips.

With these things in mind, you can carefully and confidently find a psilocybin strain that helps with nervousness. Watch out for the strength, profile of effects, safety, and setting. Just making plans ahead of time can help a lot. Start slowly every time, pay attention, and go at your own speed. You can calmly find your way to gentle relief and clear thinking if you make the right choices. Pick carefully for gentle help.

Reasons Businesses Are Upgrading Their Security Camera Systems

Businesses are realizing the necessity of security infrastructure, and improving surveillance systems is a big step. A tiny retail business or a large corporate office must maintain safety, minimize loss, and monitor activity. Advanced technology improves visibility, accessibility, and control, driving these changes. The san antonio security camera company can assist businesses upgrade their systems with cutting-edge technologies traditionally reserved for high-end facilities.

Better image quality and coverage

Contemporary security cameras have far higher resolution. Sharper photos in HD and 4K make faces, license plates, and other details simpler to identify.

- Wide-angle lenses and PTZ cover more ground.

- Improved night vision with infrared and low-light features

- Reduced blind spots with multi-cameras

These characteristics are ideal for monitoring large places like parking lots, warehouses, and stores.

Real-time monitoring and remote access

Viewing and managing footage remotely is a highly valued upgrade in contemporary camera systems. Mobile apps and cloud integration keep business owners and security teams linked.

- Motion/tampering notifications in real time

- Smartphone, tablet, and PC live feeds

- Simply share video clips with law enforcement as needed.

This remote capacity helps emergency response and decision-making under questionable circumstances.

Integration with Other Security Systems

Updated video systems now work with access control, alarms, and smart building technology. This integrated method improves security and simplifies management.

- Automatic camera-detected locking/unlocking

- Alarms for certain activities

- Central dashboard for full surveillance control

Integrations eliminate false alerts and ensure security setup efficiency.

Compliance and Legal Defense

Security surveillance is required for safety, compliance, and privacy in many sectors. Businesses can fulfill these criteria and avoid lawsuits with upgraded technology.

- Document includes timestamped video.

- Clear footage aids insurance claims

- Follow industry-specific monitoring rules

These systems also offer encrypted cloud backups to protect vital footage.

Reduced costs and long-term savings

Upgrades may seem expensive, but longevity, energy efficiency, and lower maintenance costs make them more cost-effective over time.

- Reduced camera units needed due to better coverage

- Reduce electricity use using energy-saving features

- Weatherproof and self-cleaning types require less maintenance.

Businesses can thrive while knowing their facilities are well-protected by trustworthy monitoring.

FAQ

- How often should businesses update security cameras?

Every 5–7 years or when resolution, storage, or remote access are limited.

- Is it necessary to replace or improve camera systems?

Upgrading DVRs, cameras, or software can improve many systems without replacing them.

Conclusion

Modern security camera systems improve safety, efficiency, and legal compliance for enterprises. High-resolution photography, remote access, and system integration are transforming how corporations secure people and assets. A san antonio security camera company can help you choose the proper technology partner for your security needs.

When and Why You Need Professional Antique Shipping in Dallas, TX: Expert Guide

Moving or selling valuable antiques can be daunting, especially for Dallas-area businesses and collectors who understand the risks of improper handling. Whether you’re a gallery, auction house, or private collector, the challenge of getting fragile, high-value pieces safely to their destination is real. That’s where Navis Pack & Ship of Dallas comes in. With over 30 years of expert packing and shipping experience, we eliminate the stress of antique shipping with custom solutions, professional care, and a reputation for reliability. Learn more about our specialized antique shipping services in Dallas, TX.

Why Antique Shipping Matters for Dallas Businesses & Collectors

Antique shipping isn’t just about moving objects—it’s about preserving history and protecting investments. Dallas, Austin, and Round Rock are home to museums, galleries, design firms, and private clients who depend on secure transport for their most valuable pieces. Mistakes in packing or logistics can result in irreparable damage, insurance complications, and loss of reputation. That’s why working with a professional, dependable partner like Navis Pack & Ship of Dallas is essential.

Top Reasons to Choose Professional Antique Shipping in Dallas

- Expert Packing & Shipping: With over 30 years of hands-on expertise, we use specialized packing materials and custom crating to safeguard antiques of any size or fragility.

- Custom Crating Solutions: We design custom crates and heavy-duty skids, ensuring each piece is cushioned, blocked, and braced for safe transit.

- White Glove Service: From pickup to placement in your chosen location, our full-service approach includes declared value coverage and complete debris removal.

- Flexible Pickup & Delivery Options: Choose from Door-to-Door or Door-to-Port shipping, tailored to your timeline and needs.

- Trusted Strategic Partners: We coordinate with experienced trucking, air, and ocean carriers, handling domestic and international shipments with precision and care.

How Professional Antique Shipping Works: Step-by-Step

- Consultation & Assessment: We evaluate your antiques, considering size, value, and fragility to design a custom shipping plan.

- Custom Packing & Crating: Our team uses specialized packing materials and builds custom crates to secure each piece for transport.

- Pickup & Handling: We offer flexible pickup options and white glove handling, ensuring items are moved with care and precision.

- Transport & Tracking: Your antiques are shipped via vetted, experienced carriers with real-time tracking and proactive communication.

- Delivery & Placement: Upon arrival, we provide expert placement and debris removal, completing the white glove experience.

FAQ: Antique Shipping in Dallas, TX

What makes professional antique shipping different from standard shipping?

Professional antique shipping involves custom packing, specialized materials, and experienced handling to protect fragile, valuable, or oversized items—services that standard shippers typically do not provide.

Do I need custom crating for all antiques?

Most antiques benefit from custom crating, especially if they are fragile, heavy, or unusually shaped. Custom crates provide essential cushioning and bracing to prevent movement and damage during shipping.

What coverage options are available for antique shipping?

Navis Pack & Ship of Dallas offers declared value coverage, giving you peace of mind that your items are protected against unforeseen loss or damage.

Can you handle large or awkward antique items?

Absolutely. Our expert team specializes in handling fragile, large, awkward, and valuable antiques using custom solutions and heavy-duty skids.

Protect Your Investment: Next Steps for Antique Shipping in Dallas, TX

Antique shipping requires more than just boxes and bubble wrap—it demands expertise, precision, and a dependable partner. Navis Pack & Ship of Dallas delivers custom crating, professional packing, and reliable logistics for clients in Dallas, Austin, and Round Rock. Ready for worry-free antique shipping? Learn more on our local blog page—we’ll create a custom solution tailored to your needs. Thank you for giving Navis Pack & Ship of Dallas the opportunity to earn your trust, and your business.

Calming Custody Thoughts: Clear Courtroom Coaching for Worried Parents

Parents often feel both worried and hopeful during a court-ordered custody review. Families have a lot of questions and want clear instructions on how to get ready. Parents want a fair review of their parenting skills and the health and safety of their child. They want a calm process that respects their time and their love for their child. They require frank comments from a professional. That simple experience will help keep their family safe and healthy. Parents can feel more confident and calmer with help from professionals and specific planning. Visit https://eatonfamilylawgroup.com/houston/child-custody/ for advice and specific tips on how to get your family ready.

Understanding how evaluations work

- Within private sessions, a mental health professional talks with each parent and child.

- The official doing the evaluation watches how the family interacts and carefully records emotions and behavioral patterns.

- Your answers will be about daily activities, school, and your job as a parent.

- Prepare for fair comments based on facts and written observations.

Collecting Useful Paperwork

- Obtain school records, doctor reports, and any special education papers.

- Give daily family routines, support contact information, and work plans.

- Make personal notes about your parenting plans, goals, and experiences as a caregiver.

- Letters from well-known people like teachers, doctors, or counselors should be included.

Encouraging Good Parenting

- Always be honest and transparent about what your child is saying and thinking.

- Encourage calm, honest conversations that build trust and make sure everyone feels protected.

- Set clear, predictable hours for food, sleep, and playtime to keep everything on track.

- Give praise for positive behavior and gently correct faults.

Working with Professional Guidance

- In order to do the review process correctly, you should ask clear questions about each step.

- Adhere to all suggestions very carefully to show that you are dedicated and eager to get better.

- Notify others about regular visits, appointments, and work developments.

- Visit https://eatonfamilylawgroup.com/houston/child-custody/ right now for clear next steps and full help and advice.

Having a court-ordered custody review might be less intimidating for parents when they are aware of what to anticipate. You will be able to provide the greatest presentation possible if you prepare yourself by studying about the procedure, acquiring the necessary papers, and practicing calm communication. There is a significant influence that may be made via effective parenting and collaboration with specialists. The ability to move toward a better and more stable future can be facilitated for families by preparation and self-assurance.

Starting Your Trading Journey with Axi’s Low Minimum Deposit Requirement

It can be hard to start trading, especially if you’re not sure how much it will cost. Low minimum deposit requirements make it easier to get into the market by removing a big hurdle. It’s now easier than ever to get started, whether you’re a newbie or trying out new methods. Traders may focus on improving their skills better when they don’t have to worry about money as much – Is Axi Worth It in 2025? Review and Insights.

Why a Low Minimum Deposit Matters?

With a smaller deposit requirement, more people can trade without putting too much money at risk up front. It makes it possible for:

- New traders looking into the stock market

- People trying out trading platforms or techniques

- People who don’t have a lot of money but are eager to study

Traders can focus on improving their skills instead of worrying about making big investments up front because of the low entry point.

Early Steps for First-Time Traders

It doesn’t have to be hard to get started. Here are some important things to do:

- Set up a trading account.

- Begin with the smallest deposit.

- Practice with demo accounts.

- Keep up with market trends and news.

These easy things help you feel more sure of yourself. When the financial risk is less, the learning process goes more smoothly. You could start to wonder, Is Axi Worth It in 2025? Review and Insights about the middle of your encounter.

Benefits of Starting Small

There are many benefits to starting with a little deposit. You get to learn by doing while keeping your money safe. It also helps to:

- Try out alternative ways to trade.

- Keep an eye on how people feel as the market changes.

- Better manage risk from the start.

Small steps can lead to major changes. Over time, the goal is to be consistent and disciplined.

Building Confidence Through Real Trades

Even if it’s just a little bit of real money, practicing with it gives you information that simulations can’t. You start to learn how to handle losses, make money, and stay disciplined. Every trade gives you more experience and confidence, which are both important for long-term success.

Low-deposit trading lets anyone start trading with less worry and more confidence. It’s no longer just about conserving money; it’s additionally about making room to learn, develop, and get better at things. With time and dedication, even tiny steps can lead to huge trading success.